Best Practices for Business Excellence in Geneva - Switzerland | DHAC

Expert Guides for Business Growth in Geneva - Switzerland

Get Inspired. Get Structured. Grow with Confidence.

Running an SME in Switzerland offers extraordinary potential, but potential alone doesn't guarantee success. The difference between businesses that thrive and those that struggle often comes down to fundamentals: financial clarity, strategic discipline, regulatory compliance, and operational efficiency.

Too many entrepreneurs confuse activity with progress. They're busy, but their accounting is months behind. They're growing, but don't know which products are actually profitable. They're compliant on paper, but one audit away from serious issues. They're "digital," but still drowning in spreadsheets and manual processes.

Excellence isn't about perfection, it's about having the right systems, knowledge, and practices in place so you can focus on what matters: serving clients, innovating, and scaling intelligently.

At DHAC, we've distilled decades of Swiss accounting expertise and practical experience with Romandy SMEs into frameworks that work. Not theoretical best practices that look good in presentations, but proven approaches that entrepreneurs actually implement and benefit from.

This guide covers four essential pillars every ambitious Swiss business must master. Whether you're building foundations or optimizing for scale, these resources will help you move from reactive management to proactive leadership.

Swiss regulations, accounting standards, and fiscal requirements evolve continuously. This guide provides foundational knowledge distilled from real client work, but tax rules have nuance, and your specific situation matters. Think of this as your first conversation about business excellence, not your last. When decisions carry real financial consequences, get specific professional advice tailored to your canton and business structure.

1.Accounting & Financial Management for Swiss SMEs

Financial clarity is the foundation of every successful business. Yet most Swiss entrepreneurs operate in the dark, waiting weeks for reports, hunting for invoices, unsure of their true cash position.

Modern accounting isn't about historical records. It's about real-time visibility that empowers decision-making. Can you answer these questions right now: What's your exact cash position? Which clients owe you money and for how long? What's your profitability this month?

With properly structured digital accounting systems, these answers are available 24/7 from any device. You track every transaction, monitor who booked what, customize reports for your specific needs, and manage payroll seamlessly, all while maintaining full audit trails for Swiss compliance (CO, VAT, AVS).

This foundation transforms accounting from a compliance burden into a strategic advantage.

- Smart Accounting for Growing SMEs

- Seamless Payroll & HR Management (in construction)

2.Strategic Business Planning & Advisory

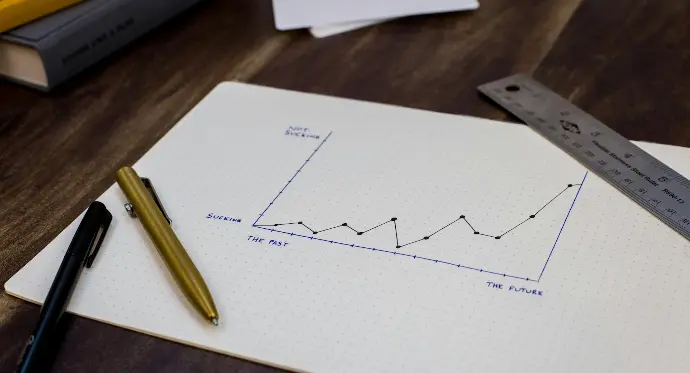

Growth without strategy is chaos. Strategy without execution is wishful thinking.

Strategic financial planning bridges your ambition with operational reality. It's the difference between reacting to problems and anticipating opportunities. Between hoping for profitability and engineering it systematically.

Effective budgeting isn't about restricting spending, it's about allocating resources to maximize impact. Forecasting isn't guessing, it's using data patterns to prepare for multiple scenarios. KPI frameworks aren't bureaucracy, they're early warning systems that catch issues before they become crises.

Risk management and internal controls aren't just for large corporations. Swiss SMEs face real risks: fraud, cash flow crises, supplier failures, key person dependencies, regulatory breaches. Proper internal controls, segregation of duties, approval workflows, regular reconciliations, protect your business while improving operational efficiency. A solid control environment isn't bureaucracy; it's insurance that pays dividends daily.

When it's time to raise capital, sell your business, or bring in partners, due diligence preparation separates amateurs from professionals. Structured documentation, clear policies, demonstrable internal controls, these aren't just good practices, they're competitive advantages that command premium valuations. Buyers pay more for businesses where risks are identified, managed, and controlled.

- Essential Guide to Financial Ratios

- Budgeting

- Risk Assessment & Internal Control Framework (coming soon)

- Due Diligence Preparation Guide (coming soon)

3. Legal & Tax Compliance

The Swiss regulatory landscape offers stability and credibility, but navigating its framework demands precision.

SA, Sàrl, Raison Individuelle? Which canton? What are your actual audit obligations under the Code des Obligations? How does VAT work for services vs. goods? When do you need an external auditor vs. limited review vs. opting out entirely?

Compliance isn't about being conservative. It's about understanding the rules well enough to optimize within them. The companies that thrive in Switzerland combine entrepreneurial ambition with rigorous regulatory adherence.

From entity structure to annual closings, from VAT returns to cantonal tax filings, from CO compliance to audit requirements, this knowledge determines whether compliance supports your growth or constrains it.

- Swiss Legal Framework & Audit Requirements (coming soon)

- VAT Compliance Essentials (coming soon)

- Cantonal Tax Optimization Guide (coming soon)

- Swiss Compliance Calendar (coming soon)

4. Digital Transformation & Process Optimization

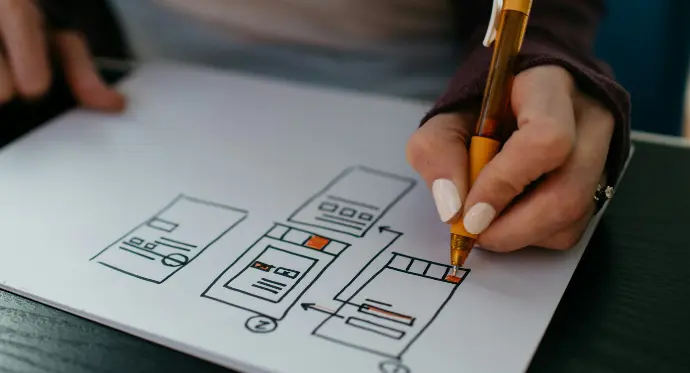

Digital transformation isn't about technology. It's about eliminating friction, reducing errors, and freeing your team from repetitive manual work.

Every hour spent copying data between systems, chasing paper invoices, or reconciling spreadsheets is an hour not spent growing your business. Every process that requires "checking with someone" creates a bottleneck. Every manual step introduces error risk.

True digitalization connects your operations end-to-end. When a sale is made, invoicing happens automatically. When inventory moves, accounting updates instantly. When approval is needed, workflows route it to the right person. When reports are due, dashboards generate them in real-time.

This isn't futuristic, it's table stakes for competitive businesses. The question isn't whether to digitalize, but how to do it pragmatically: quick wins first, proven tools, proper change management, scalable foundations.

As an official Odoo Accounting Partner, we combine deep accounting expertise with technical implementation capabilities. We don't just set up software, we design financial workflows that actually work for Swiss businesses. From chart of accounts aligned with Swiss CO requirements to automated VAT reconciliation, we build Odoo systems that accountants trust and entrepreneurs love using.

- Digitalization is not just about installing software

- Odoo Accounting Implementation for Swiss SMEs (coming soon)

- Process Automation Examples (coming soon)

- Integration Best Practices (coming soon)

The DHAC Difference

We’re not a traditional accounting firm, we’re a Swiss-founded, entrepreneur-driven partner who understands what it takes to build, grow, and protect a business internationally.

High Standards

Precision, confidentiality, and reliability are part of our DNA.

We apply the same rigor that defines Swiss finance detailed controls, verified processes, and absolute discretion to every client we serve.

With DHAC, you gain a partner who values integrity as much as performance.

Digital DNA

We believe finance should be as agile as your business.

Through automation, cloud tools, and smart reporting systems, we bring you real-time visibility and full control over your numbers.

Our goal: less manual work, more insight and decisions driven by data, not guesswork.

Entrepreneurial Mindset

We’re not just advisors, we’ve built and scaled businesses ourselves.

That’s why we understand the reality behind your spreadsheets: the pressure, the ambition, the need for clarity.

We help you transform your finance function from a cost center into a true growth engine.

Ready to Transform Your Financial Management?

At DHAC, you’re not outsourcing your accounting, you’re gaining a strategic financial partner committed to your long-term success.

Contact us (Email: info@dhac.ch or +41 78 848 83 63)